The Green Sheet Online Edition

July 9, 2018 • 18:07:01

Retail disruptors redefine commerce

Retail today is undergoing a renaissance catalyzed by business mavericks that are using technology, imagination and measured risk to connect with consumers like never before. This new breed of retail disruptors lives where growth and scale intersect and places a premium on high-quality products and services, speed and responsiveness, and the capacity to reinvent customer experiences.

Retail Systems Research, in partnership with JDA Software Inc., set out to learn what delineates retail disruptors in an online survey and personal interviews with global retail executives across multiple industries. They published their findings in a report titled How Retail Disruptors Drive Industry Change.

RSR found a majority of retail disruptors were neither very large nor small upstart companies, but predominantly in the mid-tier segment. Of the eight revenue categories measured, the largest disruptive segment was the $500 million to $1 billion revenue group (25 percent), followed by $250 million to less than $500 million (17 percent).

"I thought we'd find them in the $75 million range, but we didn't," said Paula Rosenblum, Managing Partner at RSR and report co-author. "The reason we didn't is because they don't have enough scale to really take a disruptive idea and make it manifest." She noted that disruptors had to be large enough to have industry impact but not so large as to be unwilling to disrupt status quo.

Physical store still king

By and large retail disruptors were not ecommerce pure-plays either. In fact, 87 percent of them operate stores. "From JDA's point of view, we felt very strongly that the store was going to maintain in importance, and the survey demonstrated that," said JoAnn Martin, Vice President of Retail Industry Strategy at JDA Software.

Industry expert Glenn Fodor, Senior Vice President and Head of Information and Analytics at First Data Corp., weighed in, pointing out that online moving to offline is trending, as evidenced by Amazon's purchase of Whole Foods Market Inc. "Understand that those online sales are only 10 percent of total retail sales, so it's 90 percent of the world that they're not touching if they don't have a physical presence," he said.

Researchers also discovered that no single vertical or global market dominated in the disruptive realm. While most companies in the disruptor group were focused on sustaining high-growth and profitability, disruptors were realistic about the possibility of success being short-lived, were more concerned about product than price, and were eager to embrace opportunities to support their vision.

"There is a graveyard littered with retailers that grew like weeds and then just fell apart, because they couldn't create a sustained value proposition," Rosenblum said. "It really is a matter of understanding that no market is infinite and getting to a perspective of how big the addressable market is using analytics." Based on that knowledge, retailers must calculate how much cash each store and channel will generate, the break-even point, and the revenue needed to support and adjust infrastructure, which includes everything from technology to distribution center to home office.

Disruptor big four

In segmenting retail disruptors from non-disruptors, RSR identified four distinct areas where disruptors excel: unified commerce, informed insight, customer acquisition and understanding the role of the store.

"When you think about it, unified commerce and the role of the store go hand in hand, because it's agnostic of channels," Martin said. "People are buying on mobile devices in a store and vice versa, so it's more about the experience across channel and agnostic of channel, the frictionless journey that the customer is looking for."

Non-disruptors were more inclined to rely on data-driven decisions than disruptors, who preferred a combination of data and human insights to inform business decisions. "I think they apply it well by using a judicious mix of human insight and machine insight," Rosenblum said. "I don't think you should turn over the concept of taste to a machine."

Applications for data science will continue to evolve. "JDA has a vision of being more predictive and prescriptive in their analytics, and that's exactly what the disruptors are doing," Martin said. JDA recently opened the JDA Customer Experience Center to serve as a dynamic lab for showcasing technology innovations interactively.

Leading retailers today actively track social media and shopper profiles to gauge and predict spend trends. "We are in the very infant stages," Fodor said. "We talk to merchants all the time about how can we look at the data we have to help you make more intelligent decisions. Data analytics is a huge part of commerce." He added that machines are beginning to think more like humans and advance in intelligence.

"Customer acquisition is a major focus of retailers," Martin said. "Forty-nine percent of the disruptors already have a presence on third-party marketplaces." Although considered an essential tool upfront, disruptors felt that over the long term, marketplaces distanced them from their customers, and 17 percent expected to rely on them less in the future.

Disruptors were equally focused on creating engaging lifestyle content, customer-focused activities and outstanding customer experiences to attract and retain customers. As one CEO of an online specialty grocery retailer quoted in the report said, "Product, manufacturing, fulfillment – these can all be streamlined. But the way you get your first customer, your one millionth customer – this is the way you define your business."

Still, retention is not without challenges. "Retention is harder, because customers are fickle, and their switching costs are low," Fodor said. "I can go from my Lowe's app to my Home Depot app pretty quickly and shop at a different store, and they're both good apps. If the merchant doesn't give me a good experience, I'll move to the next one." Fodor pointed out that delivery as a solution has become a trend spanning all verticals.

In terms of modifying the store model, general merchandisers scored highest for planned implementation of shop-in-shop concepts, offering customer-facing events, and repurposing stores as showrooms and service delivery locations in the future.

Tech fortification

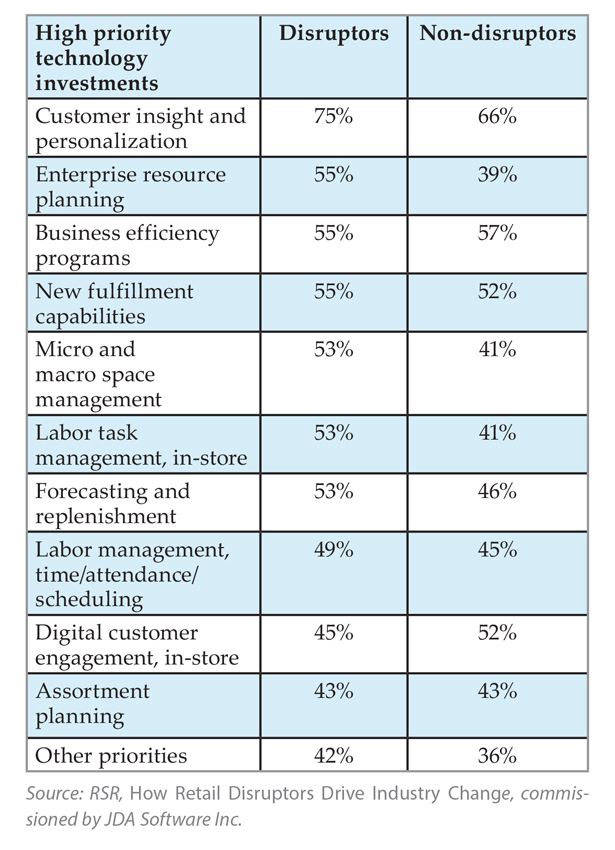

Understanding which technology investments retail disruptors place a premium on can lead to more effective bundled offerings. With the exception of business efficiency programs, digital customer engagement in-store and assortment planning; disruptors outnumbered non-disruptors in all tech investment categories RSR measured, as illustrated in the chart herein.

Retail disruptors as a whole were nimble. "Instead of quick to fail, we like to call it quick to succeed," Martin said. "Disruptors are leading the way, recognizing that being agile and trying things very quickly, versus multiyear cumbersome implementation, has become a necessity." Disruptors were more apt to react, especially as the cost of technology becomes more affordable in the midmarket and other segments as well.

"You have small merchants, which eight or 10 years ago wouldn't have been able to compete at all with large merchants and the pace of innovation," Fodor said. "The software tools that are available today have been miniaturized to be bite-sized and more consumable technology purchases for small merchants." He noted that First Data's Clover ecosystem, for example, offers about 300 merchant apps.

Another observation was that as retailers grow, their expectations change. Over the next three to five years cross-channel fulfillment is expected to drive customer traffic for 83 percent of the largest retailers, compared with 20 percent for merchants with less than $75 million in revenues, RSR noted.

Similarly, experiential offerings were prized by 63 percent of large merchants versus 30 percent of smaller merchants. "Smaller retailers wouldn't exist if they didn't create some kind of experience," Rosenblum said. "As they get larger they become more fixated on improving the experience that they offer, because there tends to be more of a sea of sameness if they don't do that."

More evenly matched were merchant expectations that loyalty programs, interactive technology and personalized marketing would drive store traffic in the future. Solve issues, drive sales Disruptors more than non-disruptors tend to invest in technology to solve real issues, rather than purely for the sake of innovation, and technology doesn't have to be perfect.

As one CIO in the RSR report stated, "Innovation for the sake of innovation is very unhealthy. If you're driving just to create change all you're doing is spending resources that could be used in a much better way. So you need to always be thinking, 'What problem are we trying to solve and how are we trying to make something – something very particular – easier.'"

RSR discovered a substantial number of non-disruptors had no plans to implement business enabling technologies, with the sharpest divide in six categories: smart mobile devices for in-store staff, radio frequency identification (RFID), personalized mobile push offers in-store, integration of Internet of Things devices and data, and in-store clienteling (a data-based method of establishing long-term relationships with key customers) and augmented reality.

"I think it's incredibly shortsighted to have no plans for smart mobile devices for your staff," Rosenblum said. "Whether it's their devices or yours, you've got to build the apps for them. And as the reader prices continue to drop, RFID is going to do some very surprising things for retailers. I believe that RFID will ultimately take away the need for in-store physical inventories, and that's a big deal."

Industry analysts have noted that as mobile push offers gain in popularity, strong opt-in features are a critical ingredient, especially now that global brands must comply with the 'right-to-be-forgotten' mandate under the General Data Protection Regulation in Europe, which went into effect on May 25, 2018.

"Just like the Wi-Fi has a unique identifier, the cell radios have a unique identifier," Rosenblum said. "From the first time that you enter an email address on that phone and it gets associated with that radio, that's when they can really start personalizing to you. A big watch out for every disruptor and non-disruptor alike is to not be intrusive. You have to walk a very delicate line."

Think disruptive

An inherent component among most disruptors was the lack of stagnation, particularly in high-turnover product categories. "There's a real challenge around product development at the moment, especially in apparel, where you really want to do iterative kinds of designs," Rosenblum noted. "My takeaway is that non-disruptors are those who are more set in their ways and are less likely to have plans for more advanced technologies."

But that doesn't have to be the case. "Technology is going to be where you differentiate yourself either through the customer experience and customer-facing technologies or internally through efficiencies that you're going to gain through internal forecasting and different sources of transportation or supply chain, speed to market," Martin said.

She added that it's not a question of size, but a question of vision and being able to execute. "Looking for scalability and getting on the technology curve is going to be a differentiator for them," Martin said. "Technology has become the price of admission for retailers."

Moving forward, the same strategies that have propelled disruptors can be applied to retail in general. Merchants will stand to benefit by being open to transforming store models to enhance the guest experience, embracing technology to solve real issues, and balancing human intelligence with data intelligence to reach critical decisions.

Ann Train is a Senior Staff Writer at The Green Sheet. She can be reached by email at annt@greensheet.com.

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.