The Green Sheet Online Edition

October 24, 2011 • 11:10:02

Oct. 1, 2011: D-Day for debit cards?

When the history of the payments industry is updated, Oct. 1, 2011, is apt to stand out as D-Day: the day debit interchange controls kicked in under the Durbin Amendment to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Said amendment instructed the Federal Reserve Board to cap debit card interchange at a rate deemed "reasonable and proportional" to costs incurred by issuing banks.

Following a contentious public comment period and implementation delays, a Fed-established cap of 21 cents plus 0.05 percent of the transaction on debit card payments (with an additional penny for issuers that take certain security measures) took effect on Oct. 1. But not without hues and cries from all sides of the debate.

The largest banks - which, combined, issue about 45 percent of the debit cards in U.S. consumers' wallets - reacted, as expected, with new fees and deep cuts in card-based rewards programs.

New York attorney Lloyd Constantine challenged claims by Bank of America Corp. and JPMorgan Chase & Co. that the fee changes were a direct result of the new interchange caps. He characterized BofA's public statements as "an attempt to rationalize and obfuscate one of the largest illegal transfers of wealth from consumers to banks in American history," in an opinion piece titled "Charging for Debit Cards is Robbery" and published Oct. 6 in the New York Times.

Constantine led a class-action lawsuit on behalf of retailers and against MasterCard Worldwide and Visa Inc. that ended with out-of-court settlements in 2003 and the card companies subsequently shelling out $3.4 billion to merchants to cover alleged overcharges.

Sen. Dick Durbin, D-Ill., who wrote the legislation that now bears his name, also took BofA to task, urging customers to "vote with your feet. Get the heck out of that bank."

Differing bank stances on new fees

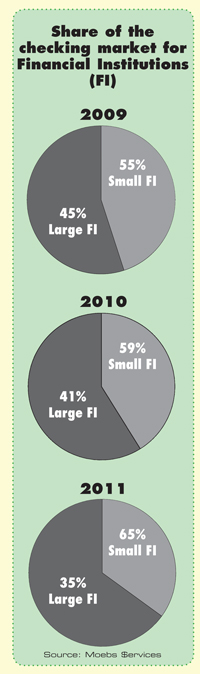

It's not as though consumers need encouragement to leave big banks: community banks and credit unions added 5 million new checking accounts for disgruntled former big bank customers last year, according to Moebs $ervices Inc., an Illinois firm that tracks consumer banking trends.

Mike Moebs, an economist and the firm's Chief Executive Officer, predicts at least another 8 million checking accountholders will flee the largest banks and turn to free checking accounts with debit cards at community banks and credit unions. "To paraphrase Mark Twain, the death of free checking has been greatly exaggerated," Moebs said.

A recent press release from the American Bankers Association seems to back that assertion. A survey of consumers conducted on behalf of the ABA in August 2011 found 71 percent pay no monthly bank account fees. Eleven percent of consumers said they paid $3 or less in monthly account fees.

Meanwhile, credit unions, card acquiring organizations and some smaller banks are making public relations hay with pledges to buck the big-bank trend by not cutting back, and even enhancing, the value of debit cards to cardholders and merchants.

Arvest Bank, a regional bank operating in Arkansas, Oklahoma, Missouri and Kansas, affirmed in October its "commitment to providing a feature-rich free checking account" with free checks, debit cards with rewards, and free online and mobile access.

But executives at most of the remaining 20,000-plus banks and credit unions said they're bracing for big dips in revenues and searching for products and services to help fill those anticipated shortfalls. "It is highly likely, especially beginning about 18 months after the effective date of Durbin that rates [charged by large and small issuers alike] will move ever closer to one another," said Lee Manfred, a Partner at First Annapolis Consulting Inc. in Linthicum, Md.

Similarly, although some retailers are reaping the fruits of lower debit interchange, tens of thousands of small to midsize businesses may be left out of the interchange fee bonanza, at least for now.

"The only retailers that are really going to be able to take advantage of this are the Tier 1 merchants" and any other businesses that have negotiated interchange-plus pricing with their service providers, said Paul Martaus of Martaus & Associates of Mountain Home, Ark.

Greater burden on consumers

Dennis Nixon, Chairman and CEO of International Bancshares Corp., said, "Government many times passes regulations that end up hurting the very people they were intended to help. This appears to be one of those cases." Headquartered in Laredo, Texas, IBC is an $11.8 billion multibank holding company with ATMs and branches serving 107 Texas communities.

In September, Nixon said the bank would shutter 55 branches operating in grocery stores to make up for anticipated cuts in debit interchange revenues rather than impose new debit card or other fees on its customers.

An analysis of the Fed's original cap proposal (12-cents instead of 21-cents), published earlier this year by a trio of respected economists, indicated consumers and small businesses alike will wind up paying more for bank services, up to $33 billion more in the first 24 months under debit interchange caps. That study - authored by David S. Evans, Robert E. Litan and Richard Schmalensee - also predicted the ranks of unbanked Americans will grow as new fees push more Americans away from banks.

Martaus noted that a similar shift occurred when the government of Australia capped debit interchange in the 1990s. "In Australia all rewards programs disappeared in 30 days of debit rates being cut," he said, adding that "prices went up at the point of sale."

In fact, a report published in 2008 by the Reserve Bank of Australia (that country's central bank) stated that limitations imposed on credit and debit interchange previously "have clearly harmed consumers by causing higher cardholder fees and less valuable rewards programmes," and by reducing incentives for banks to issue more cards.

Opportunities for smaller banks, ISOs

Martaus believes acquirers and ISOs that offer interchange-plus pricing would do well to hype the fact that customers can discern first-hand the cash flow benefits of interchange caps. Steve Norell, CEO of US Merchant Services, offered similar advice.

He said it's time for those charging interchange plus to start spreading the good news about lower prices, as well as look at selling to merchants who aren't seeing interchange cost savings from their ISOs.

Merchant Warehouse is trying to use the implementation of Durbin interchange caps to solidify its relationships with merchants. The Boston-based ISO published best practices and other advice online addressing how small merchants can use the new debit card caps to their advantage. "Small businesses need someone knowledgeable to guide them through this process, and as a payment processor, Merchant Warehouse sees an opportunity to guide and consult these merchants," said Henry Helgeson, the company's co-CEO.

Leading acquirer Heartland Payment Systems Inc. revealed it had passed along to customers over $1.7 million in lower debit interchange costs just in the first three days of October. Heartland also launched a public relations campaign, dubbed Durbin Dollars, that employs online tools and videos "to educate retailers about the rate changes and their cost savings potential," a company press release stated.

Heartland President Bob Baldwin said, "Business owners work hard for every penny they earn, and Heartland is helping them keep more of their money." He went on to describe the $1.7 million as "just the tip of the iceberg" of savings available to businesses under Durbin.

Some bankers describe the Durbin Amendment as a giveaway to large retailers. For their part, retailers balk at suggestions that the savings merchants see on debit card interchange aren't going to trickle down to consumers.

"Retailers across the nation are developing a wide range of innovative ways to pass these savings along to their customers with lower prices and better value," said Mallory Duncan, Senior Vice President and General Counsel at the National Retail Federation.

The NRF is credited with leading the opposition to legislation considered by Congress this summer that would have delayed implementation of the Durbin Amendment.

A media advisory issued by the Food Marketing Institute was more circumspect when it stated, "While we anticipate our members to try discounting for debit at some stores, this is a competitive industry, so we will only see change over time."

What is the Durbin Amendment?

The Durbin Amendment to the Dodd-Frank Wall Street Reform and Consumer Protection Act is the most consequential legislation to the acquiring sector, possibly since the industry's inception. The legislation directed the Federal Reserve Board to regulate debit cards by capping the amount of interchange card issuers can assess merchants for POS debit card transactions, and to do so at a rate it considered "reasonable and proportional" to issuer costs.

But not all debit cards are covered - just those issued by banks with assets over $10 billion. Prepaid debit cards also are exempt from price caps.

The Fed published its response as Regulation II. Here's what it says:

-

Debit card issuers are limited to collecting 21 cents per transaction, plus 0.05 percent of the ticket.

-

Issuers that undertake certain proscribed security measures can charge up to a penny more per transaction.

The Durbin Amendment also requires that debit card issuers support processing by merchants via two unaffiliated debit card networks (such as the Visa and Shazam networks), beginning in April 2012. Expect all networks to roll out new products and services in a competitive scramble.

High stakes in the bankcard game

Interchange is a huge money maker for banks. According to the consulting firm Aite Group LLC, debit card issuers were on track to earn $19 billion in debit card interchange this year before the Durbin Amendment kicked in. Aite estimated the top 50 debit card issuers, combined, could lose as much as $8 billion a year due to lower interchange revenues.

But the current price capping regimen is not cast in concrete, as the Fed will be monitoring the debit card market and collecting data on interchange costs and fees. "These data will help the Board, as well as issuers (both large and small), merchants, networks, consumers, and Congress assess whether the statute and the rule are effectively accomplishing their intended goals," Fed Chairman Ben Bernanke said in June.

Merchants and their allies are counting on that and hoping the Fed further lowers debit interchange. "The debit swipe fees that went into effect October 1 are a positive start toward fostering a competitive marketplace for plastic, but the reforms are just a first step toward correcting a much larger problem of concentrated market power that is stifling innovation in the payment card market to the detriment of merchants and consumers," the Merchants Payments Coalition wrote in an Oct. 6 letter to members of Congress.

The MPC, which led the lobbying campaign that resulted in passage of the Durbin Amendment, has complained that the Fed's new debit interchange caps aren't low enough and that businesses dominated by small-ticket items are now paying more to accept debit cards than before.

Those higher costs are not a direct result of the rate cap, but because of new interchange rates implemented by MasterCard and Visa to coincide with implementation of the Durbin price controls.

While the card companies capped debit interchange in line with what the Fed directed, they also eliminated preferential pricing that had been in place to encourage card acceptance for small-ticket items. For example, Heartland reported that its quick service restaurant clients now pay an effective interchange rate of 2.15 percent, up from 2.08 percent in September.

Katherine Lugar, Executive Vice President of the Retail Industry Leaders Association, a group based in Arlington, Va., told the congressional daily The Hill that retailers aren't about to give up battling interchange fees. "Debit is step one; credit is next, " Lugar told The Hill. "We're heading there very aggressively."

However, banking industry lobbyists told the paper that they believe retailers will have a tougher time convincing Congress to cap credit card interchange. "Credit card interchange has been historically untouchable because the value proposition is more obvious," since it's an extension of credit, Electronic Payments Coalition spokeswoman Trish Wexler told The Hill.

At this writing, no legislation addressing credit card interchange is pending in the House or in the Senate.

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.