The Green Sheet Online Edition

August 22, 2011 • 11:08:02

Research Rundown

|

'Protect the brand' drives security investments A joint study by CyberSource Corp. and Trustwave revealed nearly 70 percent of survey respondents cited the need to protect the brand as the primary driver for strengthening network security against hackers and other payment security risks. In contrast, only 26 percent said avoiding fines resulting from noncompliance with the Payment Card Industry (PCI) Data Security Standard (DSS) was the key motivator. Dayna Ford, Senior Director, Product Management at CyberSource, said the data suggests companies recognize the greatest harm caused by a security breach is reputational. "By far the most damaging impact is to the company's brand, affecting revenue, customer loyalty and even stock valuation," she said. James Paul, Senior Vice President of Global Compliance Services at Trustwave, said it was not surprising that brand integrity topped the results. "In the face of increasing numbers of security breaches and data theft, there's a real urgency for organizations to deploy powerful and effective security strategies," he said. The study, titled The Payment Security Practices and Trends Report 2011, also found that over the next 24 months, an increasing number of organizations intend to remove payment data from their networks to reduce security risks. Also, those that don't capture, transmit or store data validate PCI DSS compliance more quickly and incur fewer overall costs to manage payment security. The survey was conducted via an online questionnaire in December 2010 and January 2011. Survey respondents were required to have personal involvement in the management of their organizations' payment security practices. http://forms.cybersource.com/forms/PaymentSecurityReport2011cybspressrelease0711  |

- David Fish, Senior Analyst at Mercator Advisory Group Millennials not malcontents Research conducted by the Kenexa High Performance Institute showed members of generation Y, also called millennials, comprise, in general, a more positive workforce than the directly preceding generation X and the baby boom generation before that. According to KHPI, 60 percent of millennials are "extremely satisfied" with their employers, compared to 54 percent of both gen Xers and baby boomers. Banks jockey for mobile payment relevance A new report from KPMG International revealed that 84 percent of banking and financial services executives recognize the importance of mobile payments to the future of their organizations. In Monetizing Mobile: How Banks Are Preserving Their Place in the Payment Value Chain, KPMG researcher Carl Carande said top banks are working "feverishly" to develop mobile payment applications to stay ahead of the competition.

Demand increases for smart cards The March 2011 data breach at RSA, the security division of EMC Corp., is the primary driver of the industry shift toward smart cards and their enhanced security, according to an Aberdeen Group report. The Case for Smart Cards, commissioned by ActivIdentity Corp., identified the RSA SecureID breach as exposing weaknesses in traditional network perimeters and authentication. The multi-factor authentication provided by smart cards would make an RSA-style attack "considerably harder," the report said. |

|

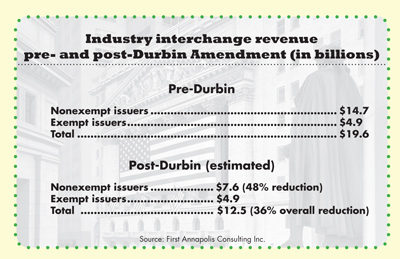

Hidden costs in mobile payments? Consumers Union, the nonprofit publisher of Consumer Reports magazine, said cardholders should get ready for the fees they will be charged when using mobile phones to make payments at the POS. According to its investigation published in the September 2011 edition of Consumer Reports, whatever costs consumers incur for using bankcards today will continue when they use mobile phones to make payments. The report, New ways to pay: At the checkout, should you use credit, debit, or cell phone?, said that as new payment options proliferate, banks and technology companies are positioning themselves to capture their shares of the $50 billion a year in fees generated by electronic transactions. "Most of the new electronic payment options are tied to credit and debit cards, so whatever costs consumers incur in using their plastic will transfer to the new methods," the consultancy said. "Paying by mobile phone won't save them money." According to the report, merchant fees will accompany mobile payments. "Google Wallet merchant transaction fees are the same as those charged on plastic payments, and the same is expected to be true for Visa's digital wallet," the consultancy said. "Square and PayPal Mobile charge merchants even more than the average big bank fee, 2.75 and 2.9 percent of the transaction amount, respectively." But consumer fees will also be part of the equation. The report found that only person-to-person money transfer specialist Obopay Inc. charges consumers a flat 50-cent fee for payments over $10. "You can transfer funds to your Obopay account from a bank account at no cost, but if you link a transaction to a debit or credit card, you'll pay a 1.5 percent fee," the advocacy group said. "So on a $100 payment, fees can run from 50 cents to $2." The advocacy predicts prepaid debit card accounts on mobile phones will be especially costly for consumers, since the cards can come with activation, monthly maintenance, transaction, balance inquiry and reload fees.  |

-Mike Goding, Senior Associate at The Strawhecker Group CEM is priority Customer experience management (CEM) software provider Tealeaf Technology Inc. sponsored an OpinionLab Inc. survey that found 87 percent of 120 participating respondents consider online CEM as more important than ever. Fifty percent said their CEM strategy is a top priority. The other half reported they are still in the CEM planning and adoption stages. SpendTrend shows rise in card spending First Data Corp.'s June 2011 SpendTrend analysis highlighted year-over-year increases in dollar volume growth: 8.8 percent in June compared to May's 6.6 percent. First Data attributed the rise to inflation, as June average ticket growth was 2.1 percent, the largest increase in over a year. The exception revealed in the report was the hospitality industry, in which dollar volume growth slowed from 11.5 percent in May to 7.6 percent in June. Debit fraud losses spur EMV adoption An Aite Group LLC impact note said the rise in debit card fraud losses is driving the transition of the U.S. payments market to the Europay/MasterCard/Visa (EMV) security standard and near field communication (NFC) technology. "Card industry executives believe that EMV in the United States is no longer a matter of if, but of when," said Julie Conroy McNelley, Senior Analyst at Aite Group and co-author of the report. "The relevance of the magnetic stripe has disappeared."

|

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.