The Green Sheet Online Edition

October 27, 2025 • 25:10:02

Stablecoins at checkout: What's stopping mass adoption?

It's easy to get caught up in the hype: stablecoins as the next big thing in consumer payments. Fast, low-cost, digital-native, and supposedly ready to challenge the traditional world of cards, wallets and BNPL.

But for all the headlines, the reality on the ground is more muted. Right now, stablecoins are barely registering in the B2C payments mix. And it's not because of regulation, volatility or technology. It's something much simpler: consumers don't see the point.

So, what's missing? And what would it take to make stablecoins a credible choice at checkout?

Lots of ways to pay, no reason to switch

I'll start with the obvious: consumers already have a lot of ways to pay. Cards work. Apple Pay is fast. Klarna and BNPL services offer flexibility. Loyalty points, cashback and seamless UX are built in. In short, the current system just works, which makes it hard for any new player to break through.

To succeed, stablecoins need more than low processing fees. They need:

- Consumer understanding and visibility

- A compelling reason to switch

- A smooth customer payment experience

- Be visible at checkout, not buried in the background

- Offer a clear, simple benefit to the consumer

- Prove they can boost conversion or loyalty for cards not just cut costs

- What happens when something goes wrong? Cards come with built-in dispute resolution. Stablecoins don't—yet.

- What about more than instant purchases? Cards support a massive range of use cases from pre-auths for car hire, to stored details for subscriptions and top-up auths for hotel checkout. No other payment type comes close to this ubiquity.

- How do you prevent fraud and misuse? Any system that moves value needs to keep criminals out. That means credible, compliant KYC and AML frameworks. Merchants won't offer payment types they can't trust.

- Are there too many coins? Right now, yes. For stablecoins to go mainstream, a few trusted names need to emerge, accepted by most merchants and acquirers, much like Visa and Mastercard dominate today.

None of those is in place today.

Learning from Klarna: Visibility matters

When Klarna burst onto the scene, it didn't start with an abstract pitch about lower costs or backend infrastructure. It made a simple, visible offer at the exact moment of purchase: you only need to pay one-third now.

Partnering with major retailers like H&M and Nike, it appeared on the product page at the moment of decision and onboarding as part of the checkout flow, giving consumers easy access and trust by association with consumer brands they knew.

That strategy worked. Klarna scaled from 10 million users in 2013 to over 100 million today, with reach across 26+ countries. Merchants bought in because Klarna increased basket sizes and conversion rates. Consumers bought in because of the credit on offer, and the easy process of sign-up. Contrast that with Open Banking. It's technically efficient and cheap for merchants but slow to gain traction in B2C, largely because consumers don't understand what it's better than cards.

For stablecoins to succeed, they'll need to follow Klarna's lead:

Without merchant buy-in and brand awareness at the checkout, stablecoins will remain niche.

Consumer incentives: Show me the rewards

Consumers are used to being rewarded when they pay, particularly in the United States. In the U.S., credit card cashback averages 1.6 percent. In Europe, it's lower, around 0.25 percent, but still part of the everyday value equation.

Stablecoins, by contrast, currently offer ... nothing. That's a problem. But it's also an opportunity. The real incentive to switch lies in the cost savings stablecoins unlock for merchants, which can be shared back with the customer.

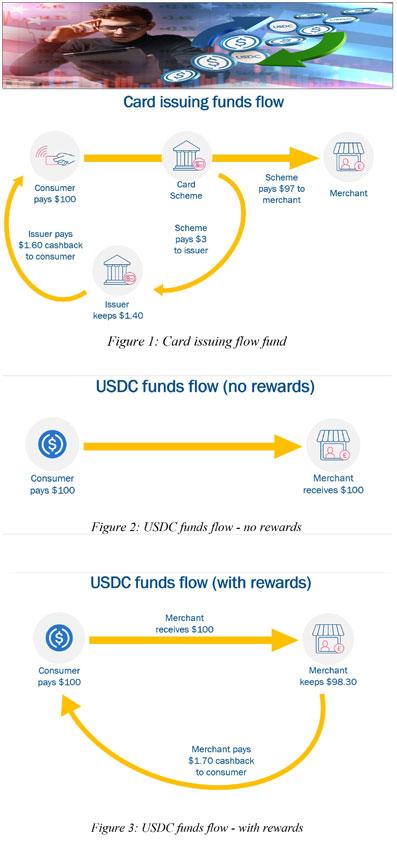

Take a look at our modeled examples in Figures 1 through 3 (using USDC as a case study, scheme fees and gas fees omitted for clarity).

The takeaway?

In the United States, merchants could offer 1.7 percent cashback on USDC payments, giving consumers more than they get from credit cards, while still retaining more for themselves than in card transactions.

In Europe, rewards need to be leaner, but still possible. Offering 0.16 to 0.25 percent cashback could match or beat credit card rewards, all while keeping costs below card acceptance levels.

The key is merchant control. By controlling when and how these rewards are offered—on certain products, time periods, or to specific customers—merchants can drive adoption without long-term cost inflation. And as trust grows, rewards can taper. This is a control that card payments do not offer, as the issuing bank determines how and when these offers are made rather than the merchant.

The lesson? Incentives don't need to be massive; they just need to be better than the status quo.

Experience still rules

Even with the right incentives, friction can kill adoption. And right now? Stablecoin wallets are clunky. They often require extra steps, unfamiliar interfaces, and lack the plug-and-play feel of Apple Pay or Google Pay.

This isn't a minor issue. UX is everything in consumer payments. Stablecoin platforms need to match, and ideally exceed, the current experience. That means: instant checkout, biometric authentication and storage of details.

No one's going to fumble with a complex wallet interface to save 0.5 percent. The experience has to feel like an upgrade, not a downgrade.

Looking further ahead: Trust, regulation, simplification

If stablecoins can overcome their visibility, incentive, and UX challenges, there's still more to solve:

In the future, we may see a short list of stablecoins accepted widely, with first movers gaining a significant advantage. But only if they can crack the adoption puzzle now.

It's not about tech, it's about trust

Stablecoins aren't a consumer payments method yet. But the opportunity is there. If providers and merchants can get serious about visibility, incentives and user experience, the pieces are all in place.

And if they can't? Well, stablecoins might just remain a fascinating idea, like voice commerce, a rounding error on the B2C payments pie chart.

Chris Jones manages PSE Consulting's business and is well known in the UK and EU for his regular insights into payments innovation. He has spent the last 20+ years leading assignments for major clients during his time at PSE and Accenture. His specializations include customer proposition development, market entry strategies and enterprise value creation. Contact him via email at info@pseconsulting.com or on LinkedIn at linkedin.com/in/chrisjonespse. To learn more about PSE, a provider of payment advisory services to professionals across the payments landscape, visit https://pseconsulting.com.

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.