The Green Sheet Online Edition

June 23, 2025 • 25:06:02

Creating a cashless society: Are we moving too fast?

The world is racing towards digitization, and the payments industry has seen the brunt force of this shift. Although cash usage is slowly decreasing globally, for many it remains essential for daily life—serving as both a budgeting aid and a protective measure during uncertain times.

As the availability of cash declines and an increasing number of businesses stop accepting it, concerns emerge about whether this shift is occurring too rapidly. Therefore, it's important to consider what measures can be taken to ensure that cash remains accessible for those who need it the most.

Cash is disappearing – and quickly

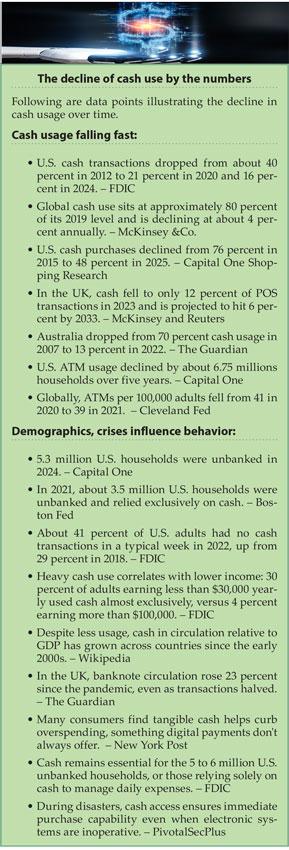

The shift toward a cashless society has gained significant momentum in the United States. According to Capital One Shopping Research, cash purchases amounted to 48 percent in 2025, falling from 76 percent in 2015 Meanwhile, in 2024, 85 percent of POS transactions globally were cashless with trends showing only 10 percent of POS transactions being cash in 2028 (see bit.ly/4e9RFVe).

This downward trend is reflected in the number of physical bank branches and automated teller machines (ATMs) available to consumers. In the United States, the population of households using ATMs has fallen by 6.75 million in the past five years, according to Capital One Shopping Research.

Retailers draw the line on cash

As cash becomes less common in the general population, a growing number of retailers are following suit by choosing not to accept it. Once an option predominantly seen in small coffee shops, this shift is now being adopted by larger, national brands. For instance, restaurant brands such as Mulberry & Vine and Sweetgreen no longer accept cash payments (see bit.ly/4087bLo).

The Case for Cash

The shift toward a cashless society has brought about two primary concerns. With living expenses on the rise, numerous consumers depend on cash to effectively manage their budgets, as physical money serves to reinforce their spending boundaries.

Furthermore, there were 5.3 million unbanked households in the United States in 2024, per Capital One Shopping Research. For this significant portion of the population, cash remains a vital lifeline, bridging the gap to financial inclusion for those without access to traditional banking.

Aside from its importance in personal finance, cash plays a vital role as a safety net in times of crisis. As geopolitical tensions and economic uncertainty rise, having access to physical currency ensures security and stability. Sweden, despite its push toward a cashless society, recently advised citizens to keep cash on hand for emergencies, while neighboring Norway mandated in late 2024 that all businesses must accept cash (see bit.ly/4480ryg).

These developments highlight the enduring importance of cash as both a financial management tool and a fallback in periods of global instability

Taking action – what’s next?

As cash use continues to decline, calls have grown louder for intervention to ensure its continued availability—especially for essential services. One area under pressure is the provision of ATMs, particularly those that are free for consumers to use.

Despite the presence of interchange fees paid by card issuers, the overall business case for ATMs remains weak. These fees—charged when customers use ATMs operated by banks other than their own—generate only modest revenue for banks.

Meanwhile, ATM operators must contend with the cost of stocking cash (which earns no interest), maintaining hardware and ensuring security. Rethinking the economic model for ATM deployment may be key to sustaining access to cash.

Reimagining cash payment procedure

Advocates in the UK are pushing for legislation that mandates all retailers to accept cash payments. However, widespread adoption appears unlikely in the near future, given the substantial financial burden it imposes on businesses.

Accepting cash presents notable operational hurdles, such as managing security risks, ensuring an adequate supply of coins for change, and navigating the logistics of depositing cash at bank branches that are becoming less accessible. Additionally, governments have little motivation to promote cash transactions, as it is often associated with the informal economy and can lead to decreased tax revenues.

A possible solution might be to implement a partial mandate that requires businesses in essential sectors, such as grocery stores and pharmacies, to accept cash payments. This approach would ensure that individuals who depend on cash for managing their budgets and during emergencies can still access vital goods and services.

Preserving access, not abandoning cash

With the rate of digitization in the world, one thing is sure: the decline of cash seems inevitable. However, it is important to manage this transition with care to ensure that vulnerable populations are protected. Cash remains a vital resource for budgeting, risk management and ensuring financial stability for consumers with no access to bank accounts.

To ensure accessibility, it's important to implement specific measures such as shared ATM networks, as well as requiring partial cash acceptance for essential services. While cash may no longer dominate, its steady decline demands attention to ensure it remains a reliable option when people need it most.

PSE Consulting Senior Manager Michelle Comfort is a chartered accountant with 20 years in professional practice and 18 years with PSE. Michelle specializes in auditing card scheme fees, pricing, feasibility studies, benchmarking surveys and scenario profitability modeling for acquiring, issuing and ecommerce. She also regularly leads acquiring supplier RFP management assignments, and owns PSE’s well known acquiring pricing model used by many clients. PSE Consulting is a leading global provider of payment advisory services to players across the payments landscape. PSE’s expertise has enabled it to deliver actionable market insights and operational optimization to senior payments leaders for over 30 years. Contact Michelle via LinkedIn at linkedin.com/in/meaprice. To learn more about PSE, visit https://pseconsulting.com/.

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.