The Green Sheet Online Edition

September 24, 2012 • 12:09:02

Research Rundown

|

Are Level 4 merchants ready for mobile? A survey conducted jointly by ControlScan and TransFirst LLC highlights mobile payment technology acceptance within the Level 4 merchant segment. Over 730 merchants responded to the inaugural Mobile Payment Acceptance Survey on technology preferences and merchant perceptions about consumer demand for mobile payment options. "Consumer-based mobile technology solutions are exploding in the marketplace, promising to fundamentally change the merchant-consumer dynamic," said Dave Abouchar, ControlScan Senior Director of Product Management. "As small business experts, we want to understand how the Level 4 merchants we and our acquiring partners serve are adapting to this change." Survey respondents answered a series of questions related to three significant mobile payment scenarios: consumer use of mobile devices to access and make purchases on merchant websites; merchant acceptance of card-present payments via smart phone or tablet devices; and consumer use of mobile phones at the POS to make payments. Key merchant findings from the survey:

According to Abouchar, the survey will be repeated in the future to monitor Level 4 merchant progress toward adoption of mobile payment technologies. "Our goal is to understand merchants' technology-related concerns and needs so we can continue to provide products and services that promote business growth," said Craig Tieken, Director of Product at TransFirst. "The Mobile Payment Acceptance Survey has given us valuable insights to better engage and inform our customers." For complete survey results please visit

|

Big data in retail According to RIS Roadmap Series data, the ability to manage big data will become fundamental to retail operations in the near term. Maximizing Big Data-Enabled Opportunities in Retail outlines six mile-posts for capitalizing on big data opportunities and offers industry insights from leading experts on how to unlock critical tools during each stage of big data management implementation. Compass on payment fraud A Compass Plus white paper titled The Rise and Fall of a Fraudulent Transaction discusses the evolution of financial services over the past decade and the coinciding emergence of pervasive fraud in an always-connected world. The paper also addresses how the financial sector can rise to the challenge by continuing to deploy multiple layers of security protection. Universality of smart devices According to First Data Corp., consumer expectations of an integrated buying experience driven by smart device technologies are blurring the lines between in-store commerce, e-commerce and mobile commerce. In Universal Commerce: Adapting to the Power of Smart Devices, First Data reveals how smart devices are changing traditional commerce and the potential implications for merchants and financial institutions alike. |

|

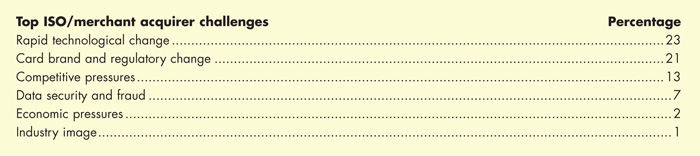

Acquiring industry's annual checkup The sixth annual Mercator Advisory Group report on U.S. merchant acquiring offers an in depth analysis and discussion of market performance by the nation's leading acquirers, the issues surrounding counterparty risk and indicators that suggest dramatic changes for acquirers at every level, whether merchant, processor or bank. "The U.S. merchant acquiring market, while concentrated heavily in the top tier of players, is actually quite diverse when it comes to the opportunities for firms of various kinds to share in the overall industry," said David Fish, Senior Analyst for Mercator's Credit Advisory Service and the report's author. According to Fish, the traditional view of acquirers as bank members of card networks that own or sponsor processing of card transactions via those networks, and thus hold the risk associated with those transactions, is changing. The paper explores the liability chain linking entities in the acquiring network and the potential risk to each party involved. "In reality, the acquiring bank passes liability for merchant card transactions downstream to partner intermediaries and is only one of four types of entities that could potentially own merchant contracts and risk liability that those contracts will go bad," Fish said. New to this year's report is a market share analysis and market division by acquirers, processors and banks. Report highlights include:

For more information about this report, please visit

|

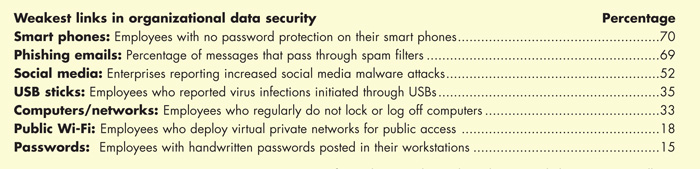

BYOD risky business A survey conducted by research firm ITIC and security awareness training firm KnowBe4.com found only 13 percent of the 550 businesses surveyed employ specific policies for dealing with bring your own device (BYOD) deployment. Seventy-one percent of respondents reportedly allow BYOD among employees, yet only 37 percent believe their businesses are ultimately responsible for taking device-related security measures. Billers to push more plastic A Treasury Strategies white paper suggests that converting consumer bill payments from paper and automated clearing house payments to card transactions could streamline the overall cost and risk associated with payment acceptance, especially from the underbanked. As a payment option, Optimizing the Collection Portfolio estimates the average cost to biller per debit or credit card transaction is $1.65, versus $2.72 for check transactions. Digital wallet wars A Forrester Research report titled Why The Digital Wallet Wars Matter forecasts which wallets could ultimately win in the marketplace. "The real promise of digital wallets lies within their ability to facilitate payment while simultaneously enabling smarter, more efficient commerce through delivery of value-added services - before, during and after the payment moment," stated Forrester Senior Analyst Denée Carrington. |

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.