The Green Sheet Online Edition

March 26, 2012 • 12:03:02

Research Rundown

|

Mercator report examines global status of EMV When Europay International introduced the 1993 initiative to migrate to chip-embedded credit and debit cards in an effort to reduce fraud, it couldn't have foreseen nearly two decades later the technology would still be relatively unknown in certain parts of the world. The Europay/MasterCard/Visa (EMV) international standard for chip and PIN technologies created in 1999 has helped drive the initiative, but in the United States migration to EMV is just beginning. Mercator Advisory Group's latest report, The State of EMV Adoption: A Global Update, explores global markets with the greatest potential for EMV growth and the catalysts most likely to drive demand for EMV in the future. According to the report, the most progressive nations achieved universal EMV compliance starting as early as 2007, while other countries have only partially embraced the initiative, failing to upgrade all cards and terminals operating in the field. Highlights from the 31-page report include:

Michael Misasi, Mercator Research Analyst and author of the report, said China is the latest major market to commit to a national EMV migration initiative, which has the support of the Chinese government. He believes China's initiative will likely ensure a significant increase in global demand for EMV cards and terminals. "Visa's U.S. liability shift may have a similar impact in the world's other EMV holdout, but given the country's strong mag-stripe preference, it remains to be seen how swiftly merchants and issuers will respond without a government mandate," Misasi said. www.mercatoradvisorygroup.com

|

- Norty Cohen, founder and CEO, Moosylvania ETA/TSG Economic Indicators Report The U.S. Economic Indicators Q4 2011 Report released Feb. 29, 2012, by The Strawhecker Group and the Electronic Transactions Association showed continued growth in acquiring portfolios due to lower account attrition, improved retention and net new account gains. Bank debit and credit card volumes also trended higher, with Visa Inc. up 9.7 percent and 5.4 percent, respectively, and MasterCard climbing 18.2 percent and 6.3 percent, respectively, from the fourth quarter of 2010 to the fourth quarter of 2011. Redemption for mobile coupons According to the Juniper Research Ltd. white paper, Mobile Coupons - The Road to Redemption, the global redemption rate for mobile coupons will average about 8 percent by 2016, eight times the redemption rate for paper coupon campaigns. Juniper predicted that by 2016, there will be over 600 million active mobile coupon users worldwide. Bright future for smart cards A Research and Markets report titled Smart Card Market Forecast to 2014 projects global shipment of smart cards will increase at a compound average growth rate of 12 percent in the next few years. In 2011, an estimated 61 billion smart card units were shipped globally. EMV migration, government support and growing demand in emerging markets are among the factors expected to contribute to smart card growth. |

|

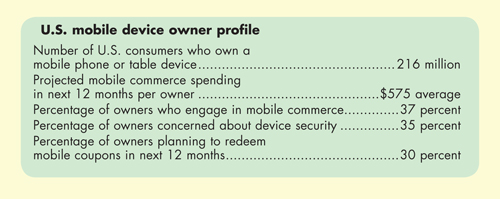

Consumer catalysts for mobile payments A February 2012 white paper by research firm Park Associates estimated that all mobile payment technologies combined processed over $10 billion in transactions in North America in 2011. According to the paper Mobile Payment - Stepping into Uncharted Territory, 50 percent of U.S. households with broadband own smart phones, and just over 50 percent of those expressed interest in having mobile phones with bar code scanning functionality. Park Associates also determined that 80 percent of current U.S. mobile phone users have web browsers on their mobile phones. Roughly 37 percent of those surveyed found the concept of a mobile wallet appealing, particularly among younger users and those owning smart phones. "For consumers, the most attractive benefit of mobile payment apps is they reduce the number of credit cards they have to carry," stated Harry Wang, Director, Mobile and Health Research for Park Associates. "The mobile phone is the main device people use to organize their lives, and mobile payment solutions offer significant conveniences, including organizing receipts and eliminating the need to carry cash." The white paper also explores new developments in mobile payment technologies and solutions, and analyzes current and future benefits to consumers, mobile carriers, small to midsize businesses, brick-and-mortar merchants, and mobile application and solution developers. Topics covered in the paper include:

www.parkassociates.com"

|

- Sean Collins, Global Head, KPMG Communications and Media Hospitality embraces POS innovations Hospitality Technology's annual POS Software Trends 2012 report delves into the hospitality industry's top priorities for POS software innovation. Speaking with leading POS software developers, HT found most were focused on launching options to help mobilize operators and connect them directly with customers to enhance visibility enterprise-wide. Social media and cloud computing are also expected to continue to dominate software development in this sector. Riding the NFC wave According to MarketsandMarkets' Near Field Communication (NFC) Market - Global Forecast & Analysis (2011 - 2016) report, which projects the future market for NFC chips, tags, readers and NFC-based, micro secure-digital cards - mobile payments will be the most attractive application for NFC technology through 2016, as will access control, ticketing, advertising and data sharing applications. Maximize tradeshow ROI With the tradeshow season in full swing, preparation and execution are top of mind for payments industry exhibitors. A 19-page Matrix Impact white paper, The Impact Trade Show System, opens with the question: Are you getting the ROI you need from your tradeshow investment? The paper is filled with tips for preshow planning, including how to draw attendees to your booth, sales targeted questions for booth visitors and effective post-show strategies. |

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.