The Green Sheet Online Edition

March 14, 2011 • 11:03:01

Research Rundown

|

E-commerce platforms evaluated Javelin Strategy & Research's E-Commerce Platform Review: A Detailed Comparison of 11 Internet Payment Processing Solution Providers takes a look at selected e-commerce processors' products, value propositions, marketing positioning and differentiation. E-commerce transactions comprise a growing share of the overall retail market, creating a reason for merchants and payment processors to expand their platforms for card-not- present payment acceptance and processing, according to Javelin. The report highlights how processors differ greatly in their offerings related to international processing, fraud and security, recurring billing, reporting and other back-end processing functions. The report addresses the following questions:

Among the processors surveyed were: Adyen, Chase Paymentech Solutions LLC, CyberSource Corp., Elavon Inc., Fifth Third Processing Solutions LLC, First Data Corp., First National Merchant Solutions LLC, Litle & Co, Merchant e-Solutions Inc., PayPal Inc. and WorldPay US Inc. Javelin collected the data using detailed vendor questionnaires and in-depth interviews conducted with senior vendor representatives, or through secondary research, company profiles and other reference materials on the provider's positioning and technology. The intended audience for the report includes those involved in businesses related to online retailing, merchant acquiring, e-commerce platforms, payment gateway services and other payment technologies, payment networks, online banking and others. www.javelinstrategy.com Primary POS  |

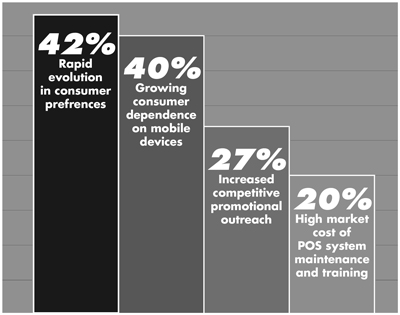

- Patricia McGinnis, Director in Mercator Advisory Group's Banking Service Mobile users ready for mobile payments New research by Accenture shows that nearly half (45 percent) of the most active mobile device users would welcome the opportunity to pay for goods and services via mobile phone, despite the fact that 73 percent expressed significant privacy and identity theft concerns. Retailers integrating POS In a survey conducted by Aberdeen Group of over 100 retailers on use of in-store POS devices to interact with customers, 42 percent said they are moving beyond simple transaction processing and are integrating POS systems with marketing, merchandising, inventory, and customer relationship management (CRM) data. Vending goes cashless In a survey conducted by Apriva, a wireless transactions processor, among 200 National Automatic Merchants Association members regarding the adoption of cashless payment technologies in the vending space, 57 percent of respondents said they expect to either integrate or expand the use of cashless technology in 2011. Credit cards post 13-month high According to data released by First Data, transaction growth on credit cards was at a 13-month high in January 2011, and year-over-year credit dollar volume growth was the second highest in over a year. |

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.