The Green Sheet Online Edition

February 14, 2011 • 11:02:01

Research Rundown

|

Has debit use peaked? Mercator Advisory Group's newly released report, Debit Cardholders: Calm Before the Storm, highlights consumers' growing use of debit cards in 2010. The report reflects what may be a period of peak usage prior to the significant impending changes to debit pricing that implementation of the Durbin Amendment to the Dodd-Frank Act will bring. Based on a national sample of 1,009 consumers completed in May 2010, the report outlines consumer patterns of debit card ownership, usage, preferences for PIN versus signature transactions, awareness of overdraft reform legislation, participation in alternative and decoupled debit programs, and participation in debit card rewards programs. Report highlightsFindings from the report include the following:

"Looking at the positive achievements of consumer debit programs through our newly acquired Durbin Amendment lens, we must highlight the attributes most likely to change (such as rewards programs), procedures potentially causing confusion (such as PIN versus signature transactions), or programs that may experience collateral damage (such as decoupled debit programs)," said Ken Paterson, Vice President for Research Operations at Mercator Advisory Group.  |

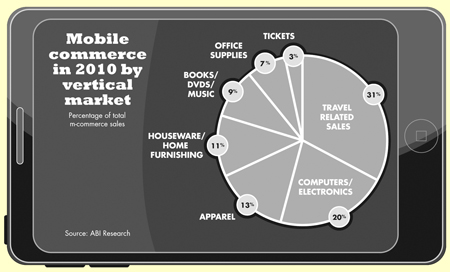

- John Waldron, Honeywell Scanning & Mobility Getting ready for mobile Tego Interactive released the first in a series of white papers and business how-to "CheatSheets," providing insights into mobile commerce and payments, as well as strategies to achieve mobile retail readiness. News from the cyber fraud front Cybersource Corp.'s 12th Annual Online Fraud Report indicates that, in 2010, the average percent of online revenues lost to payment fraud ranged from 1.1 percent for small merchants to 0.4 percent for the very largest merchants. Credit sales down in December Capital Access Network Inc.'s Q4 2010 Small Business Credit Sales Report shows that Main Street brick and mortar retailers, service providers and restaurants recorded their 13th consecutive quarter of year-over-year credit and signature debit card sales decline in the fourth quarter of 2010, with card sales off 2.56 percent from the same quarter in 2009. Opportunities in India The Mercator Map of India: An Overview of the Subcontinent's Payments Market report provides an overview of the Indian banking; credit, debit card and prepaid card; and emerging payment technology markets. "For those who understand it, the Indian payments market presents tremendous opportunity," said Ben Jackson, Senior Analyst of Mercator Advisory Group's Prepaid Advisory Service. |

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.