The Green Sheet Online Edition

December 28, 2009 • 09:12:02

Fighting the payment squeeze:

Alternatives retailers may consider

It is no secret that it costs retailers billions of dollars to accept card-based payment products every year. Many industry reports claim that payment fees are the second-largest line item of expense, right after the cost of personnel. Retailers are being squeezed, because if they stop accepting payment cards, their customers are likely to walk.

Yet merchants don't have a great deal of clout in influencing the fees charged to them, particularly interchange. It is only natural that financial institutions want to do whatever they can to protect the current fee structure, particularly since this income stream represents 27 percent of total banking revenues, according to consulting firm McKinsey and Co. Indeed, you could make the case that financial institutions' very survival depends on fees they make from card payments.

Given today's new economic environment, is there anything retailers can do to influence or lower their costs?

Inadvertently, consumers may already be making an impact as they tighten their use of more expensive credit cards and transition to less costly debit transacting. Some are even returning to the use of checks and cash. But this shift will probably not help the overall costs in a significant way; it also may not be permanent. Furthermore, processing checks and cash does not come cheaply and carries other risks.

Payment alternatives

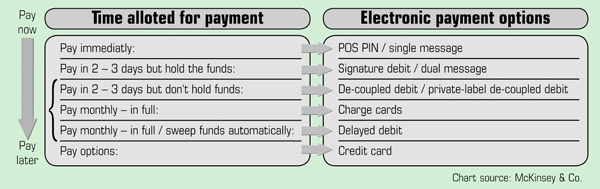

In considering options retailers might turn to it is helpful to look at the overall electronic payments spectrum depicted in the sidebar accompanying this article.

At the beginning of the spectrum is the well-entrenched, low-risk use of debit cards. At the end of the spectrum is the well-entrenched credit card, which carries high risk to issuers and high cost to retailers. The middle area has been largely ignored but has begun to spur product innovation, as well as re-introduction of old products such as the charge card.

Several payment products in this middle space have been the brainchild of groups that have never been in the traditional payments business. PayPal Inc. is the premier example. It started with a single product but has expanded into an array of offerings.

American Express Co. is re-introducing its traditional charge card and advertising it as a way for consumers to better manage their spending. Brokerage houses are taking a greater interest in issuing delayed debit cards, whereby the consumer grants permission to the issuer to pay charges monthly using funds held in a brokerage account.

Finally, decoupled payment products are designed to let issuers of payment products - retailers, intermediaries or financial services companies - debit checking accounts through the automated clearing house (ACH) systems operated by the Federal Reserve System.

Decoupled options

Decoupled products are of interest to retailers because they have a lower cost structure and represent a way to build customer loyalty. Decoupled products can work two ways: as a private-label, retailer issued product or as a co-branded card issued in partnership with a bank.

The private-label option entails no interchange, and transaction fees are low. Sounds like a great deal. But getting into the private-label business is not for the faint of heart. The payments industry is complex and requires issuers of the programs - banks or retailers - to actively manage their programs, or hire third parties with the expertise to do so.

In addition, costs are involved in producing cards, marketing and offering cardholder rewards. Rewards used to be differentiators, but those days are gone. Today's customer expects to be rewarded, so forgoing rewards is not an option if success is to be achieved.

Also, retailers have to absorb losses because ACH payments provide no guarantee to merchants. Retailers are responsible for 'not sufficient funds' and closed accounts in the same way they bear responsibility today for returned checks. As you can see, the cost saved from not paying interchange could be consumed by the cost of the program if not carefully managed.

A better option for the unseasoned and smaller retailer looking at payments is more likely to be a decoupled, co-branded product. Co-branded means the cards have a national payment brand and appear no different than any other debit card to merchants. They are accepted anywhere the brand is accepted. This is a partnership between a retailer and the bank issuer, which takes on the cost of managing the program and shares some of the revenue with the retailer partner.

These products are relatively rare today and are issued by financial services companies that specifically target this business. The deals are negotiated but generally have some combination of lower interchange rates when the card is used at the merchant's location and a share of interchange revenue when the card is used at other merchants' stores.

Mom-and-pop challenges

Can smaller merchants take advantage of these programs? The question is one of mass. How can small retailers gain traction? One way is to create domains of merchants participating as groups. One domain could be geographic - local merchants who collectively issue cards. Rewards points are pooled and used at local merchants.

Another type of domain might be a retailer category, such as bookstores. In this case a decoupled card can be used at any bookstore; reward points are collected and used at any bookstore.

It will not be as easy for smaller merchants to participate as it is for larger merchants, but the effort could be very worthwhile. The good news is that systems are in place to handle these newer products. Several companies are making strategic investments to prepare for the emergence of nontraditional payment products.

To support the new products, not only do systems need to be readied, but innovation also has to flow among all interested parties. The innovation must be able to support the current payment infrastructure, or failure is assured. Take biometrics as one demonstration of technology that promised all kinds of new opportunity, but it also required new investments in equipment at the POS - not good.

As for the bottom line, what will this mean for retailers? Well, it depends. I believe retailers will find ways to reduce their costs or optionally participate in payment revenues to a greater extent than what we have witnessed to date.

Retailers will be more willing to try new payment types to regain some of their influence. This will probably be driven by larger retailers, but it does not necessarily mean smaller retailers should not be looking for solutions that fit their footprint. We are clearly not going to go backward to cash and checks; the momentum will move on, but cost will be a major - if not the major - driver going forward.

As Director, Payment Solutions for Total System Services Inc., Pat Morgan develops products and product strategies for the company and specializes in debit payments. TSYS is working on several alternative debit payment products that leverage the automated clearing house for clearing and settlement. Pat can be reached at patmorgan@tsys.com.

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.