The Green Sheet Online Edition

May 29, 2007 • 07:05:02

Statement analysis for cave men

Have you seen the Geico insurance commercials in which cave men are portrayed living among us? They attend parties, see therapists, dine in restaurants and are offended when they hear "So easy even a cave man could do it."

Clearly the card Associations responsible for creating the U.S. interchange model have not tried to make things easy to understand.

And in training, many ISOs err in showing brand new merchant level salespeople (MLSs) three different interchange calculators with fancy spreadsheets. While great for experienced MLSs, it's difficult for new agents to understand every field.

I am not a big fan of leading with savings alone; however, every agent should be able to complete an accurate cost-savings analysis for prospective merchants. If your eyes glaze over when faced with an Excel spreadsheet containing 28-plus fields, this article is dedicated especially to you.

Finding the numbers

It is imperative to have a basic understanding of processing statements so you can explain them to your customers. Always have a calculator with you, regardless of the method of your presentation (phone or face to face).

You must identify a number of figures to effectively complete a cost-savings analysis:

- Processing volume

- Number of transactions

- Qualified discount rate

- Transaction fees, including interchange assessments

- Batch/automated clearing house (ACH) deposit fees and nonbankcard fees

- Monthly fixed fees for statement, customer service, gateway, wireless service, basic service, report, debit, etc.

- Minimum monthly fee or adjustment

- Downgrade fees: mid-qualified, nonqualified, corporate and so forth.

Some items are charged per occurrence. It is not necessary to include these in a comparison, unless their total is substantial. Examples of these include:

- Chargeback fees

- Retrieval requests

- ACH change fees

- Voice authorizations

- Address Verification Service surcharges

- Annual fees

- ACH reject fees.

Locating the fees

Processing volume and the number of transactions should be on the cover page or in a summary page. You must have this to show merchants exactly how much you can save them. You will find the qualified discount rate near the volume. It will be formatted like this: 1.97% or 0.0197.

Transaction fees can hide in batch areas of the statement or summary sections. They may be separated by card brand, or brands may be grouped together. Also, per-item fees and interchange fees may be separated.

Batch and nonbankcard fees could be included in the total number of transaction fees or listed as a separate line item in the summary section.

All other fees should be listed in the fees summary, but this is not always done. If not, find them buried in the statement.

Discerning the difference

Illustrating the difference between merchants' current pricing and what their pricing would be if they signed with you is fast and easy. Anyone can do it. It's also straightforward and easy to teach.

However, it will not work if a merchant is priced with interchange-plus pricing. At that point, you will be comparing the "plus" and/or the additional value you bring to the table.

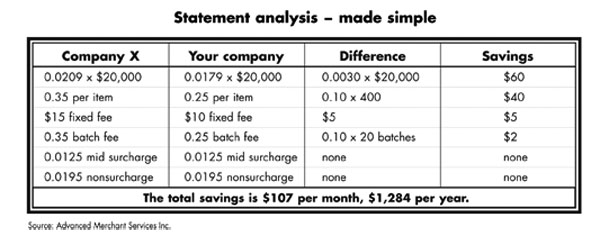

The chart entitled "Statement analysis _ made simple" found within this article shows exactly how such a comparison would work for a merchant doing 400 transactions in 20 batches per month and $20,000 in processing volume.

It reveals how the merchant could save $1,284 annually by switching processors.

Keeping it simple

To determine the amount you will save a merchant in terms of rate (qualified, mid or non), follow this formula: Subtract your rate from the merchant's current rate. Example: 0.0199 - 0.0169 gives us 0.003. Then multiply 0.003 by the merchant's volume. This will identify the savings faster than any other way.

Important: If the rate is not disclosed, divide the fee by the volume. (Some processors hide everything except the actual cost.)

Exposing the savings

Merchants love to see savings in writing. So, create a form for this purpose. Many industry pros have done analyses on the backs of napkins. However, it's always better to be professional.

Advanced Merchant Services has templates partners can use to professionally demonstrate savings: one for traditional statement analysis and another to show savings on PIN-based debit, when applicable.

While quite obviously simplified, this formula has helped hundreds of ambitious new MLSs understand the basics of uncovering savings.

If you prefer an Excel spreadsheet, your ISO more than likely will be able to provide one.

AMS uses several spreadsheets for advanced training; I'm always happy to share. I look forward to hearing your success stories. Feel free to let me know how I can help you develop a million-dollar portfolio.

Jason A. Felts is the founder, President and Chief Executive Officer of Florida-based Advanced Merchant Services Inc., a registered ISO/MSP with HSBC Bank. From its onset, AMS has placed top priority on supporting and servicing its sales partners.

The company launched ISOPro Motion, its private-label training program, to provide state-of-the-art sales tools and actively promote the success and long-term development of its partners. For more information, visit www.amspartner.com, call 888-355-VISA (8472), ext. 211,

or e-mail Felts at jasonf@gotoams.com.

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.