The Green Sheet Online Edition

June 9, 2025 • 25:06:01

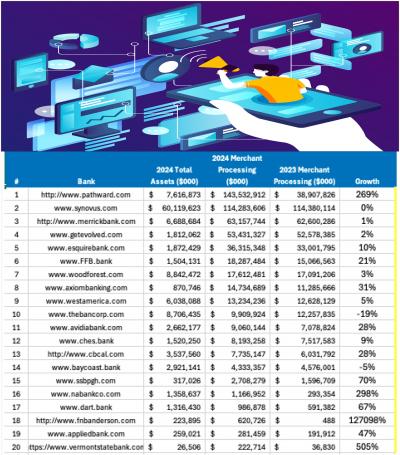

Merchant processing: Call report reporting

The Federal Financial Institutions Examinations Council publishes Bank Consolidated Reports of Condition and Income quarterly. These reports, known as call reports, can be used to compare bank performance. One of the required data categories is the year-to-date merchant credit cards sales volume. It is possible to search and compare processing by bank and see the growth from one year to the next. Measuring growth year to year Table 1 accompanying this article is populated using the FFIEC’s year-end 2023 and 2024 published bank call reports. cdr.ffiec.gov/public/ManageFacsimiles.aspx.

Table 1

I excluded banks with assets in excess of $10 billion and included some smaller banks with either significant year-over-year growth or large processing relative to assets. I also added Synovus, as it is a common sponsor bank. Keep in mind that this is not a top 20 list.

Additionally, this table is only as good as the bankers who complete their call reports. Both Mission Valley Bank and Cross River Bank’s call reports, for example, did not indicate they processed in either 2023 and 2024, yet we know they are acquirers.

It is interesting to see both the growth in processing and the volume relative to asset size. Unlike lending, bank processing volumes are not constrained by the size of their balance sheets. Bank loans are constrained by deposits.

A bank may only lend what it has on hand in the form of deposits or equity capital. And banks do not want to lend all the funds they have; that could lead to a liquidity crisis. Further, banks must maintain sufficient capital to meet specific capital ratios, or face sanctions by their regulators – which comes with an entirely different set of issues.

A shadow balance sheet

Merchant processing does not have capital requirements. Processing is a shadow balance sheet item, as it is not reflected within the balance sheet. Banks like Merrick, Esquire, Pathward and FFB process many multiples of their asset size. Tiny SSB Bank with only $317 million in assets processed over $2.7 billion in 2024.

Banks typically make money based on the spread between the rate charged borrowers for loans and the cost of those funds from depositors. Income from loans is the bank’s interest income. Income from merchant processing is non-interest income and is coveted by banks, as it is less volatile. Interest income fluctuates based on the federal funds rates, which vacillates with the economic cycle.

Consequently, if a bank is willing, and regulators and the card networks allow, unlike with loans, a bank is not constrained by its assets. Merchant processing income is insulated from fluctuations in interest rate changes. To be sure, processing volume will be muted during recessionary times, but it is not as directly impacted as interest rates.

Powerful data at your fingertips

It is also interesting to examine the growth in the portfolio of select banks. Some of the smallest banks have the fastest growth. David Leppek (www.linkedin.com/in/davidleppek/ ) and I recently hosted an APP-sponsored webinar on BaaS.

We discussed that, in junior high school, we learned through the properties of transitivity and in sexual education, the virus of your partner’s partner is your problem. This partner risk is magnified at smaller institutions, as their smaller capital could more easily be impacted.

The FFIEC bulk data is readily available to compare many aspects of bank reporting including non-interest income, total income, cards processing and assets. Use it, along with other evaluation tools, to monitor your bank partner or to compare the relative health of banks to each other. It's powerful information.

As founder of Humboldt Merchant Services, co-founder of Eureka Payments, and a former executive for such payments innovators as WePay, a division of JPMorgan Chase, Ken Musante has experience in all aspects of successful ISO building. He currently provides consulting services and expert witness testimony as founder of Napa Payments and Consulting, www.napapaymentsandconsulting.com. Contact him at kenm@napapaymentsandconsulting.com, 707-601-7656 or www.linkedin.com/in/ken-musante-us.

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.