The Green Sheet Online Edition

November 14, 2011 • 11:11:01

Country-specific alternative payments

Just as customers prefer to make purchases in the currency of their own countries, they also favor specific payment types. Online retailers have found that working effectively with international customers means they must offer locally preferred payment types.

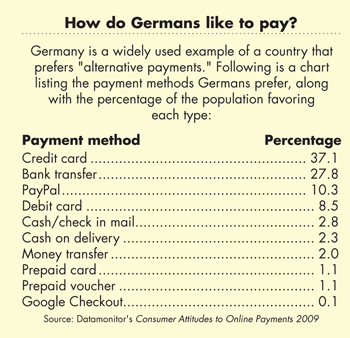

While traditional credit and debit cards are utilized heavily in the United States and the United Kingdom, that is not the case throughout the world. The best example of this is in Germany where 70 percent of all online transactions are conducted using nontraditional payments. Research has shown that 24 percent of customers, globally, will abandon sales if their preferred payment options are not available.

Common types of payments used internationally

What are the types of local payments used online internationally? They fall into four categories:

-

1. Real-time bank transfers

2. Prepaid or domestic cards

3. Vouchers

4. E-wallets

Let's take a moment to define these categories.

- Real-time bank transfers allow consumers to make instant bank transfer purchases from their banks. Examples of this type of payment are regional - such as GluePay in Europe. Or they are country specific or locally used. For example, in Slovakia, consumers use Sporopay; in Germany, they select Sofortuberweisung.de or GiroPay; in the Netherlands, they use iDeal; in Spain, they employ laCaixa; and in Finland, they use Euteller.

- Prepaid or domestic cards can be loaded online or in a store, and then either used in another store or in an e-commerce environment. Examples of this type of card used internationally are the Neosurf relied on by consumers in France, Italy, Spain and Belgium, and the toditoCash used in Mexico.

- Vouchers are types of local payments generated online and printed; then cash is paid in physical stores or outlets. In Brazil, consumers opt for the Boleto Bancario. In Chile, they use Santander. In Poland, they favor the eCard.

- E-wallets have generated buzz lately and are proliferating around the world. Consumers from Argentina, Mexico and Chile use the DineroMail. Buyers from Sweden, Norway and Denmark reach for the eWire.

How to help merchants reach an international clientele

Let's say you are working with an e-commerce merchant who wants to expand his or her payment capabilities to be more appealing to German consumers. The real-time bank transfer widely preferred in that country is the sofortuberweisung.de. In fact, 31.1 percent of merchants in Germany are already offering this payment type. Offering this option is particularly important if your merchant wants to target young German shoppers because 66.7 percent of that demographic select sofortuberweisung.de when checking out.

Online merchants in the United States understand they need to offer automated clearing house as a payment type for their customers because it is a popular form of alternative payment in this country. Similarly, merchants selling in other countries must make informed decisions about the consumer payment preferences in those markets and then align with the appropriate partners to offer country-specific alternative payments. Sales increases and revenue will follow.

Caroline (Carrie) Hometh is the Executive Vice President, Sales for RocketPay LLC. She can be reached via email at chometh@rocket-pay.com; via office phone at 978-255-3109, wireless at 978-807-5047 and direct at 978-462-3459; via the web at www.rocket-pay.com; via Facebook at www.facebook.com/pages/RocketPay/142009625847128; and via LinkedIn at www.linkedin.com/company/rocketpay-llc. She regularly tweets at: http://twitter.com/rocketpay.

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.