Page 48 - GS180601

P. 48

Feautres

TSG's new directory of U.S. acquirers

he Strawhecker Group recently released its lat- Smart strategies

est report on U.S. merchant acquirers. Titled

Directory of U.S. Merchant Acquirers, it provides That doesn't mean significant growth isn't occurring

T data on more than 256 acquirers and ISOs, further down the list, particularly for the companies

including processing volume, number of transactions, that have partnered with or acquired ISVs and/or state-

technology, mergers and acquisitions (M&A) activity, and of-the-art gateways and are approaching merchants with

other factors contributing to growth. comprehensive business solutions, rather than leading

with payment processing. Experts have long discussed the

Most noteworthy to Jared Drieling, TSG's Senior Director need to make this transition. The data from TSG indicates

of Business Intelligence, is that Worldpay now occupies the companies doing so are succeeding.

No. 1 spot. "There was a large merger between Worldpay

and Vantiv and now, under the Worldpay brand, it has Reflecting upon the traditional acquiring model, Drieling

become the largest merchant acquirer," he told The Green said, "Upgrades, cost, service problems, software that's not

Sheet. interconnected, different portals that aren't talking to each

other – these can be a nightmare for merchants."

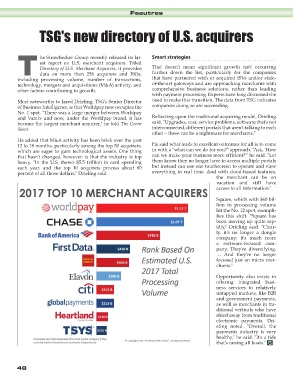

He added that M&A activity has been brisk over the past

12 to 18 months, particularly among the top 50 acquirers, He said what leads to excellent outcomes for all is to come

which are eager to gain technological assets. One thing in with a "what can we do for you?" approach. "Ask, 'How

that hasn't changed, however, is that the industry is top can we make your business more efficient?'" he said. "Let

heavy. "In the U.S, there's $5.5 trillion in card spending them know they no longer have to access multiple portals

each year, and the top 10 acquirers process about 80 but instead can use one touchscreen to operate and view

percent of all those dollars," Drieling said. everything in real time. And with cloud-based features,

the merchant can be on

vacation and still have

access to all information."

Square, which with $60 bil-

lion in processing volume

hit the No. 12 spot, exempli-

fies this shift. "Square has

been moving up quite rap-

idly," Drieling said. "Clear-

ly, it's no longer a dongle

company; it's much more

a software-focused com-

pany. They're diversifying.

… And they're no longer

focused just on micro mer-

chants."

Opportunity also exists in

offering integrated busi-

ness services to relatively

untapped markets, like B2B

and government payments,

as well as merchants in tra-

ditional verticals who have

shied away from traditional

electronic payments, Dri-

eling noted. "Overall, the

payments industry is very

healthy," he said. "It's a tide

that's raising all boats."

48