The Green Sheet Online Edition

March 12, 2012 • 12:03:01

Interchange under attack

Following a formidable ascent, debit cards may be falling out of favor with the U.S. buying public - a casualty of debit card interchange price caps instituted in accordance with the Durbin Amendment to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. In addition, any increases to credit card interchange could be short-lived if banks and the card companies fail to prevail against a new legal challenge to interchange.

That challenge, on anti-trust grounds, comes from a group that includes 5 million merchants, the National Retail Federation and the National Restaurant Association. It accuses Visa Inc., MasterCard Worldwide and about a dozen banks of collusion in setting credit card interchange.

Plaintiffs argue that the average credit card interchange, at 2 percent of the ticket in the United States, is far in excess of what merchants pay in any other country. In the European Union the interchange rate on a Visa or MasterCard credit card transaction runs 0.3 percent; in Australia it is 0.5 percent.

"This could have far-reaching implications for the business," noted industry consultant Paul Martaus. But Lee Manfred, Partner, First Annapolis Consulting, said, "We're not done. There are plenty more tactics to be played out in the debit arena, and continuing on the credit card front, too."

This latest legal challenge is pending in the U.S. District Court for the Eastern District of New York and is being presided over by Judge John Gleeson, who is expected to render a decision in the fall of 2012. Gleeson was the presiding judge in the so-called "Wal-Mart suit." That lawsuit was settled out of court in 2003 after Visa and MasterCard agreed to refund billions of dollars to merchants for alleged interchange overcharges.

The new lawsuit could be even more costly. According to CardHub.com, a website that tracks consumer card spending, retailers paid $27.7 billion in credit and debit card interchange during 2010. If retailers prevail in this suit, the court could require reductions in interchange of 50 percent or more, in addition to punitive damages.

Felix Salmon, a financial expert who blogs on the Reuters news website, calculated assessed damages could exceed $90 billion, since retailers claim they've been overcharged since settlement of the Wal-Mart case. Recent public filings by MasterCard and Visa suggest the two companies combined have stashed away about $5 billion in special trusts to cover potential liabilities arising from the pending litigation.

Visa's Chairman and Chief Executive Officer, Joseph Saunders, addressed the class action suit during a Feb. 8 call with investors and hinted that a settlement was in the works but that Visa would not abide by major changes to interchange. "Visa is unwilling to agree to any significant or long-term credit interchange rate reductions or any settlement agreement that doesn't provide a full resolution to that and other key issues," he said.

This latest threat to credit card interchange comes as the industry and the marketplace adjust to caps on debit card interchange, as required under the Durbin Amendment.

In commenting on debit card interchange regulation, Lyle Beckwith, Senior Vice President, Government Relations for the nac National Association of Convenience Stores promised to pursue more reforms. "With similar reforms to credit card swipe fees, we will see these consumer benefits multiply," he said.

Manfred isn't convinced merchants will prevail in challenging credit card interchange. "I don't think the same conditions are present that came into play with debit," he said. "He added that unlike debit cards, which some argue are substitutes for checks and thus should be priced similarly, "there's no alternative product with widely different economics."

Credit card transactions are extensions of credit; as such they carry risk, which needs to be considered when prices are set, he noted.

Life after Durbin

Preliminary data suggests consumers are curbing their use of debit cards since debit interchange caps took effect in October 2011. Visa, for example, reported that growth in credit card payments outpaced growth in debit card payments for the first time in at least 5 years during the three months ending Dec. 31. Visa credit card volume was up 12 percent; debit card payments grew just 9 percent.

However, some acquirers and ISOs believe the Durbin Amendment has been good for business. One example is Heartland Payment Systems Inc., which placed No. 6 on The Green Sheet's list of top acquirers in 2011 (see "2011 Acquirers Report," GSQ, Vol. 14, No. 4, December 2011).

Heartland Chairman and CEO Robert O. Carr said in a Feb. 9, 2012, earnings call that he expects the Durbin Amendment to fuel growth at the New Jersey firm, which has generated significant goodwill by passing "Durbin Dollars back to our merchants." Carr estimates the typical Heartland merchant will save about $1,000 annually per location on debit interchange.

"As the noise and confusion gives way to the reality of monthly statements, we expect new account acquisition will come down to the savings experienced by the individual merchant, and that's why we really like our chances going forward," Carr said.

"He added that the company's interchange rebate program has also proven a valuable recruitment tool: Heartland added 47 new relationship managers in the last fiscal quarter. "Sales professionals are coming to us and saying they want to work for an organization like Heartland that is treating its merchants this way," he said.

Georgia-based ISO Vantage Card Services Inc. published an online analysis of how its merchants fared under the Durbin Amendment caps. Card-not-present merchants - including e-commerce, MO/TO and touch-tone capture merchants - are saving the most, with an average 88 basis point (0.88 percent) reduction.

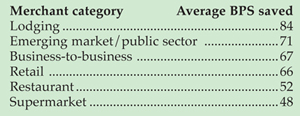

Here's a rundown of other big winners post-Durbin Amendment, listing the average number of basis points (BPS) saved per merchant category:

The average regulated PIN debit interchange rate paid by Vantage clients in October 2011 was 61 basis points, with Visa about 42 percent lower than nonregulated debit card interchange, and MasterCard nearly 37 percent lower. Sixty-nine percent of debit card transactions Vantage handled in October were issued by regulated banks; Visa cards made up 79 percent of those regulated transactions, Vantage reported.

Although many merchants are faring well under the Durbin Amendment rules, an Ipsos Public Affairs consumer survey in January 2012 found only 7 percent of respondents believe retailers are passing along savings generated by lower debit card interchange. The survey, commissioned by the American Bankers Association, also found only 6 percent of consumers believe retailers ever intended to pass on savings from lower debit interchange.

"We shouldn't be surprised; Congress gave retailers a handout with no guarantee that the savings would be given back to consumers," said Trish Wexler, spokeswoman for the Electronic Payments Coalition.

The EPC seized on the survey results to press consumers to hold retailers accountable. The Washington-based group launched Where's My Debit Discount?, a website that uses surveys and field research to determine how much of an estimated $8 billion a year in debit interchange savings merchants are passing along to consumers.

The EPC collected market data directly before the debit interchange caps took effect last year, as well as shortly thereafter, in October and November.

The same items were purchased on each trip to the same 21 stores nationwide. Stores surveyed included Wal-Mart Stores Inc., Walgreen Co., 7-Eleven Inc. and Home Depot U.S.A. Inc., each of which was active in lobbying for the Durbin Amendment.

Twelve of the stores surveyed increased prices by an average 5.1 percent, four kept prices the same and five stores lowered prices.

"Overall results demonstrate that customers paid 1.7 percent more for the same products after the [interchange] rule was implemented," the EPC noted in "Where's the Debit Discount? Durbin Price Controls Fail to Ring Up Savings for Consumers." The report is available at http://wheresmydebitdiscount.com.

Boon for big-box merchants

Senator Bob Corker, R-Tenn., predicted such an outcome in an opinion piece published at Politico.com in the fall of 2011. "And what about the savings we were promised in the form of lower retail prices?" wrote Corker, a member of the Senate Banking Committee.

"I wouldn't waste time looking for those. Interchange revenue will just go to the big-box retailers' bottom lines - while consumers foot the bill." Corker went on to describe the Durbin Amendment outcome as "a self-inflicted wound by a Congress more interested in scoring political points than doing the right thing by the American people." Adil Moussa, Senior Analyst at Aite Group LLC, said of Durbin Amendment regulations, "It's been an utter failure."

Evidence appears to support these assertions. Home Depot Chief Financial Officer Carol Tome revealed during a February 2011 call with investors that the company's financial benefit of debit interchange caps could total as much as $35 billion a year. Tome noted that debit cards make up about 17 percent of payments at Home Depot.

A survey of attendees at the 22nd Annual Direct Response Forum, held in August 2011, found 41 percent of card-not-present merchants attending the forum had no plans to pass along savings on debit card interchange to customers.

Analysts have said they aren't surprised by the data; market reaction so far in the United States resembles what occurred in 2003 after the Reserve Bank of Australia capped debit card interchange in that country. A study undertaken by MasterCard in 2005 suggested most merchants in Australia didn't even know the fees had gone down.

That research also showed a marked reduction in debit card usage as a result of the caps, in addition to a general increase in costs to Australian consumers because merchants were also allowed to surcharge credit and debit card payments.

"Australia is now saddled with a more expensive payments system that delivers fewer benefits to cardholders, distorts market competition, suppresses technological innovations, and allows large merchants that enjoy near monopoly market power to take advantage of the situation to gouge customers," MasterCard stated in a paper, "Interchange Regulation: Lessons Learned From RBA Intervention in Australia."

Convoluted fee schedules

MasterCard and Visa each have taken steps to boost income in recent months with the introduction of new fees and fee structures.

MasterCard announced a new Annual License and Registration Fee, as well as a new third-party processor registration fee, based on total annual volume of credit and signature debit transactions (prorated for 2012 since it won't go into effect until July 1).

Meanwhile, Visa has a new network participation fee, charged to acquirers on a per merchant site basis.

Martaus predicted Visa will get blowback on the network participation fee, which could cost as much as $85 a month for a merchant exceeding 4,000 locations.

"That's $85 per location," he said. Assuming acquirers pass along the charges, "that could prove a real burden. There are a lot of retailers out there with 4,000 locations," that will balk at the new free, he added.

After reviewing Visa's latest interchange fee schedule, which includes more than a dozen changes that take effect in April 2012, Martaus said he had more questions than answers.

"The math they used is something so complex that it's left a lot of experts scratching their heads," he said.

Notice to readers: These are archived articles. Contact information, links and other details may be out of date. We regret any inconvenience.