Maverick Payments

News from the Wire

18:06:39 (UTC) 12-17-2025

2025 PayTech Women Awards highlight leaders in 20th anniversary year

20:12:42 (UTC) 12-11-2024

Maverick Payments recognized at 2024 Disruptor Awards

17:18:07 (UTC) 06-10-2024

Maverick Payments integrates to Visa Acceptance Platform with Q3 live date

19:12:40 (UTC) 02-14-2024

ETA, Discover unveil Forty Under 40 honorees, YPPs

17:00:45 (UTC) 08-17-2023

Maverick Payments makes Inc. 5000, 3rd consecutive year

16:13:58 (UTC) 04-25-2023

Maverick Payments named ISO of the Year at ETA Transact

19:26:23 (UTC) 04-20-2023

Maverick Payments launches Connect

20:12:21 (UTC) 02-10-2023

ETA, Discover recognize 40 industry trailblazers

Stories from

The Green Sheet

Build Your Book of Business with Niche and Emerging Merchant Verticals

We’ve come a long way from the early days of payment processing, when countertop terminals rolled off assembly lines and electronic authorizations and settlement began to permeate the market. Over time, as more businesses accepted payments electronically, ISOs and merchant acquirers looked for ways to add value to existing solutions. Gift card and electronic check processing became popular. Hardware and software became more customized; salespeople became more consultative.

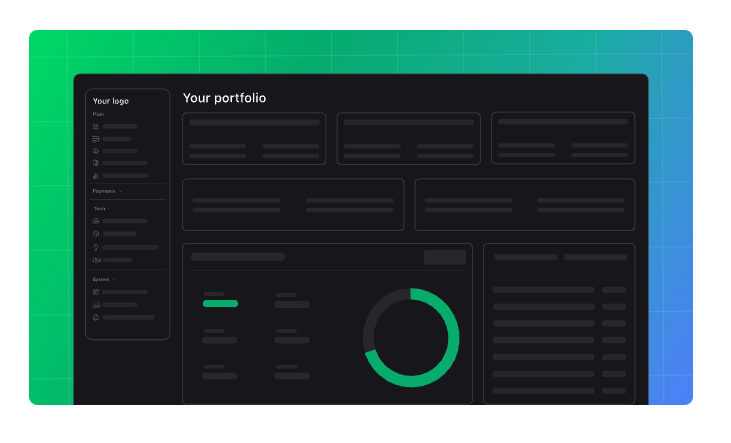

In today’s world, standalone payments are not enough to win over new merchants, who seek out processors that offer inclusive product stacks with expanded value adds. Salespeople that specialize in select vertical markets and help merchants tailor solutions to meet the needs of their specific business and industry have a leg up over others. Maverick Payments collaborates with ISO and ISV partners to deploy purpose-built, technology-lead solutions supported by a responsive, in-house back office to help merchants stand out from competitors, delight customers and grow their businesses.

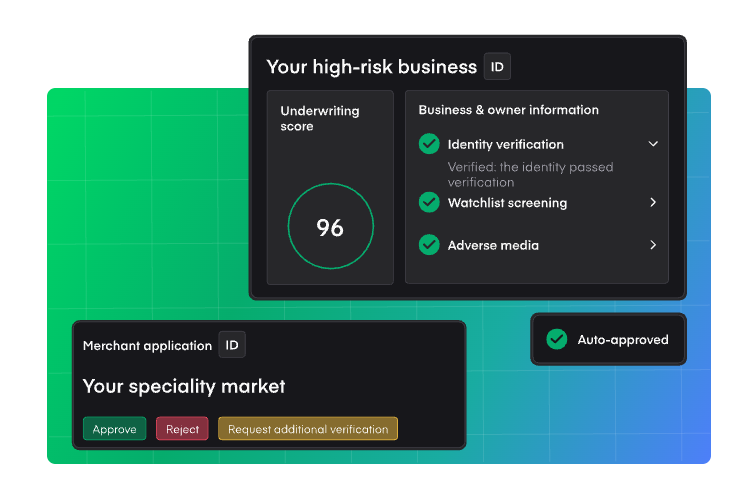

Niche and emerging verticals have risen over the past few years, and yet, surprisingly few payment processors support emerging markets. In fact, numerous ISOs and acquirers reject merchant applications that don’t fit standard risk profiles or Merchant Category Codes (MCCs). This is often due to reputational or regulatory risk levels that are unknown, as the vertical is emerging. The reality is that with a nuanced understanding of regulations and transactional trends, these merchants could present significant opportunities. For too many legacy fintechs, this rigid approach to risk management hearkens back to early days of uniform POS terminals and vanilla processing. At a time when advanced analytics and algorithms can instantly score a merchant account, why limit underwriting to a few generic models?

Don’t leave money on the table

Have you personally vetted legitimate businesses, only to see them declined by risk management? If so, here’s some good news: Maverick Payments is here to help. Its one-stop tech stack includes many solutions tailored to the unique needs of merchants in traditional and emerging markets. Here are some ways Maverick enable its partners to attract and retain more specialized customers.

- Multibank network: Optimize approval rates and increase the volume of accounts by processing card or ACH transactions through Maverick’s banking network to ensure continuous payment flows.

- Fraud prevention tools: Protect profits with easy-to-use, multifaceted fraud prevention tools built into Maverick’s powerful online merchant and partner-facing dashboard. These tools safeguard customer data and help merchants separate valid customers from fraudsters.

- Chargeback management: Quickly resolve disputes and chargebacks using built-in dashboard tools that equip you for success.

- Enhanced reporting: Stay ahead with advanced analytics that provide actionable insights on customers, trends, competitors, and industry benchmarks.

- Risk mitigation: Leverage expert in-house underwriting, QA and risk teams to receive comprehensive risk mitigation from due diligence to compliance management.

Capture new revenue flows & boost brand loyalty

More merchants enter the mainstream market every day that can use an industry expert like you. You deserve to cash in on this trend with custom solutions and comprehensive risk management, bundled together and elegantly branded with your logo for increased brand loyalty.

If you’re tired of being turned away by processors that do not accept applications from tobacco and vape stores, online pharmacies, firearms dealers, debt repayment services, online gaming platforms and more, Maverick Payments is ready to turn no into yes. Its team will help you and your customers navigate all the requirements and necessary due diligence to get your merchants approved and processing.

Visit Maverick Payments website for more information or to get started!

maverickpayments.com/partner-greensheet

Build Your Book of Business with Niche and Emerging Merchant Verticals

- Apr 24th, 2025

Empowering ISOs to Thrive in a Crowded Market - With Less Risk and Distraction - Jan 22nd, 2025